- The Mortgage + Media Newsletter

- Posts

- Buckle Up, Bonehead!

Buckle Up, Bonehead!

It's about to get bumpy (like it wasn't already)

March 4th, 2024

This week has a lot to be keeping our eyes on, with just a glimmer of hope that we pray isn’t doused with a fire hose before next weekend.

Homebuyers are getting the blues

And home prices aren’t helping them

But they can always rent

Until the bank forecloses on their landlord

But wait, could rate cut hopes still be on the table?

Doesn’t matter, ‘cause our government blows

Plus, Elon Musk is ready to throw down with another tech giant again, except this time the giant is one of his own.

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, let’s get to it!

The Mortgage Part

😢 Homebuyer Blues: A growing number of potential homebuyers are losing hope that they’ll ever be able to afford a home with high costs of living and too-low income.

🏡 Price Spike: Home prices jumped 5.5% over the last year as demand stays high and inventory near record lows

🏦 Renting Still Hot: Even though supply of rental properties is up, demand has kept the market competitive. But, we have still seen rents come down about 1% nationally

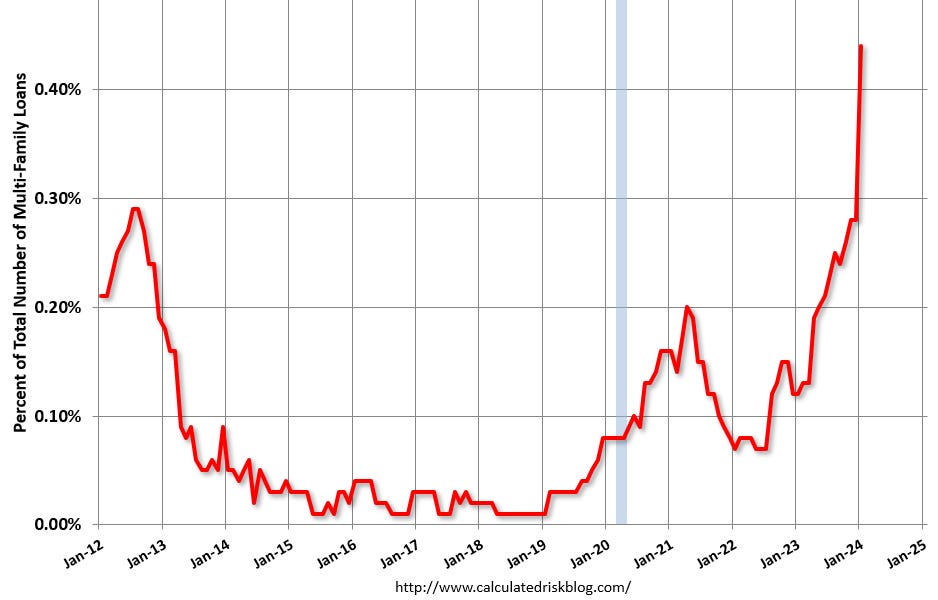

📈 Investor Trouble: Multifamily home owners are struggling to keep up with higher prices, rates, and vacancies, making the highest delinquency spike since the Great Recession

🙏 Hope Isn’t Dead Yet: The Fed may still be able to drop their rates in June despite a bump up in the inflation rate last month

🏛 Actually, It Probably Is: Congress narrowly passed a super-temporary spending bill to avoid a government shutdown… again. But the catch is it’s only until Friday, after that the shutdown is on!

% Mortgage Rates: Still over 7%, but had a slight drop to finish the week

🔍 Coming this week: All eyes are on the big jobs report that will tell us how hot this economy really is

The Media Part

🥊 Elon Picks Another Fight, This Time With His Own Baby

Elon Musk has filed a lawsuit against OpenAI, the AI research organization he co-founded, alleging a departure from its original nonprofit mission. Musk claims that OpenAI, under the leadership of CEO Sam Altman and President Greg Brockman, has shifted focus towards profit, contrary to its founding principles.

Established in 2015 as a nonprofit endeavor to develop AI for public benefit, OpenAI received substantial funding from Musk, who later withdrew from its board in 2018 citing concerns over its direction.

The lawsuit asserts that OpenAI's actions, including the formation of a for-profit subsidiary and collaboration with Microsoft, deviate from its intended purpose. Musk specifically objects to the licensing of OpenAI's GPT-4 AI model to Microsoft, alleging a breach of nonprofit obligations.

While Musk's motivations have been questioned, with some pointing to his own AI startup, xAI, as a potential competitor, OpenAI has refuted the allegations. Chief Strategy Officer Jason Kwon expressed disagreement, while Altman lamented the departure from a focus on technological advancement.

Musk's apprehensions regarding AI's risks are notable, as he has previously voiced concerns about its potential dangers. Despite participating in a call to pause testing of powerful AI systems last year, OpenAI maintains its commitment to safety in AI development.

The unfolding legal battle between Musk and OpenAI marks a significant moment in the intersection of technology, ethics, and business.

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. This week instead of calling clients, spend your days calling your Washington reps and tell them to get their 💩 together before all of it hits the fan!

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.