- The Mortgage + Media Newsletter

- Posts

- This is your fault! Numbers were great and it sucks and now we're screwed 🤦♂️

This is your fault! Numbers were great and it sucks and now we're screwed 🤦♂️

This Week's Market + Media Update with JohnB

The only newsletter (probably) where you can get the latest market trends, mortgage news, and social media updates all in one place

🔥October 23rd, 2023🔥

Last Week:

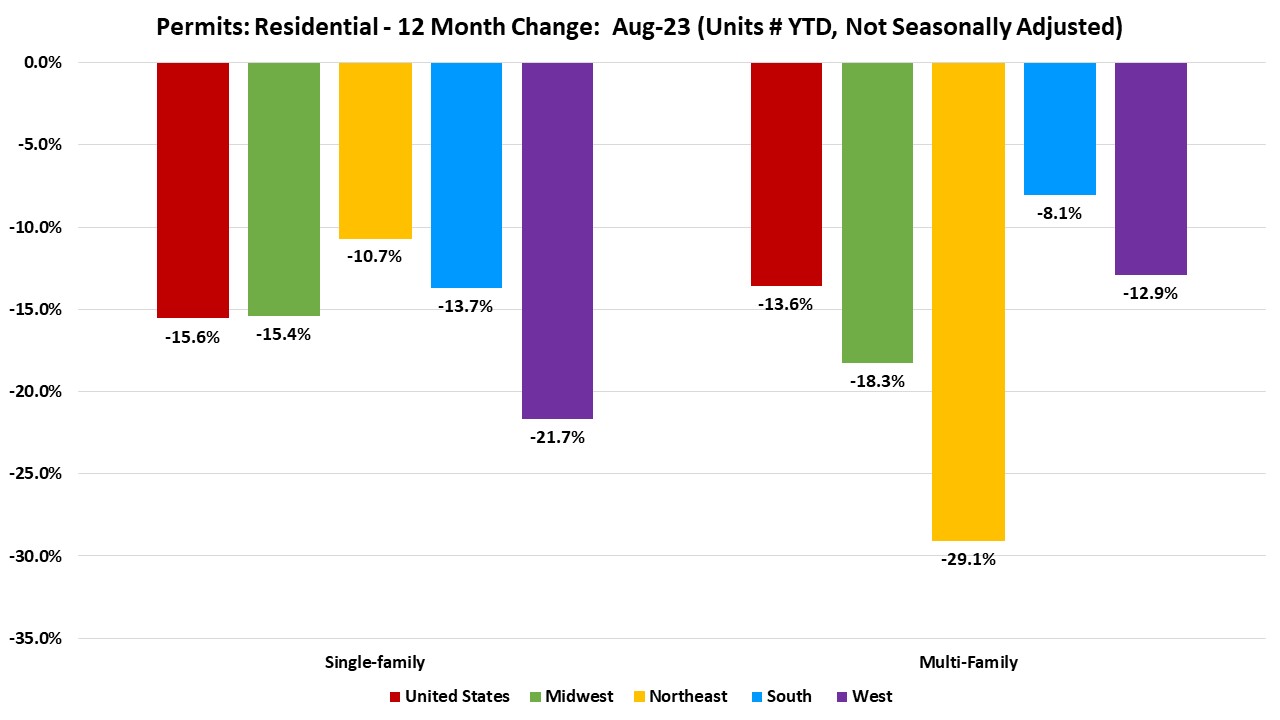

Homebuilders ain’t feeling homebetter

Y’all are buying too much

The Fed is ready to take inflation down, even if that means taking the rest of the economy with it

The House starts back from scratch to find a Speaker

Treasury yields hit a new peak, showing the uneasiness of the market

Rates were back up to new records last week, hitting the dreaded 8% mark

Plus, more Canva+AI fun and some secret sauce on Google SEO 😮

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, now let’s get to it!

The Mortgage Part

Check out this week’s video 📽👇

👷♀️ Homebuilders: Sentiment drops to the lowest level this year as we see single-family construction continues it’s decline

💵 Retail sales: Way up in September, sparking fears that the Fed will need to keep rates high for longer than expected

🥊 The Fed vs. Inflation: Fed heads say we aren’t anywhere close to seeing any rate relief. We’ll need the economy to take a turn for the worse first.

🏛 The House Remains Speakerless: The government continues to sit idle as Jordan looses 3 straight votes for Speaker. The GOP now starts from scratch to stop the chaos

📈 Treasury Time-bomb: The 10-year yield, an indicator for mortgage rates, hit the highest level since before the Great Recession

% Mortgage Rates: As I was afraid of, mortgage rates jumped despite improvements the previous week. We set a 21st century record, hitting 8% before dropping back down slightly

🔍 Coming this week: Home prices, GDP, and the Fed’s fave inflation indicator: the PCE

The Media Part

🔥 Canva + AI is just too much fun

Last week at our Canva+AI: Magic at Your Fingertips online class we explored the plethora of new AI tools Canva just rolled out. We played with things like:

Magic Design for Presentations

Magic Write (with brand voice)

Magic Switch to make our content go so much farther

Magically transforming a presentation into a blog post with a click

Magic Edit, Extend, Erase, and Morph in a single pic

Magic Media to create AI-generated images and video

Magic Design to create a video with that AI imagery

And the crazy part, we only scraped the surface! There is so much you can do it will blow your mind 🤯 You have to get in there and try it out for yourself! And if you missed the first session on Friday, jump onto one of the other options I have coming up this week. See you there!

Tuesday, October 24th at 10AM EST

Wednesday, October 25th at 12PM EST

🤐 The Secret Sauce: Ingredients for a Winning Google Ranking

Search engine optimization is an ever-evolving practice as Google continuously tweaks its algorithm. But many of the core best practices remain unchanged when it comes to achieving high search rankings.

As an SEO consultant, I'm often asked what are the most important factors to focus on. Based on my experience and knowledge, I'd say page speed, mobile optimization, backlink profiles, on-page optimization, high quality content, and user experience are critical.

With Google's mobile-first indexing, sites that load fast and adapt for mobile devices tend to outperform. Earning backlinks from reputable sites boosts credibility and rankings. Optimizing title tags, meta descriptions, headings, image alt text for target keywords improves on-page SEO.

And good old fashioned unique, useful, engaging content written for humans instead of search engines trumps tricks and hacks. While no one can crack Google's entire algorithm, keeping these best practices in mind serves as a solid general SEO strategy.

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. This week watch for the GDP numbers and major inflation indicator, the PCE. These will tell us where the economy is and what the Fed might do next. Note: If either comes in high, that could be bad news for those of us that want to see rates coming down soon 😥

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.