- The Mortgage + Media Newsletter

- Posts

- I'll let it go this time, but it better not happen again 😠

I'll let it go this time, but it better not happen again 😠

This Week's Mortgage + Media Update with JohnB

January 16th, 2023

Last Week:

We have a few things to be hopeful for as 2024 really starts to kick into gear, but there are also some possible warning signs we need to keep our eyes on

Buyers are back and ready to dance

We’re feeling pretty good about mortgage rates

Inflation was a little up, and we can only let that slide once

We’re probably not getting a Fed rate cut any time soon

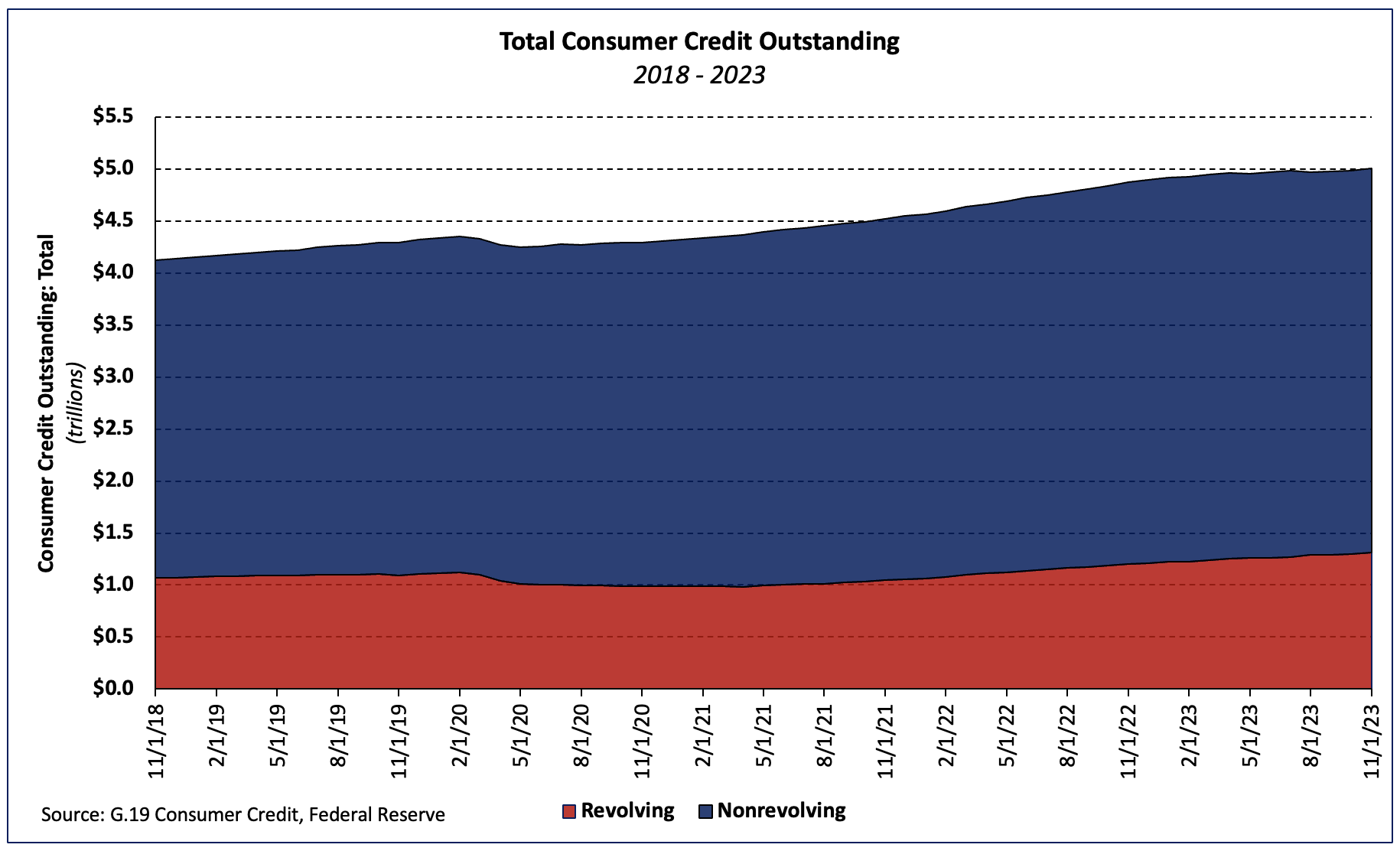

Revolving debt keeps on the ups, is it still in control?

We avoided a government shutdown for now. But it' wasn’t graceful and it’s far from over

Plus, I’m inviting you to a first-of-its-kind social media strategy event!

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, now let’s get to it!

The Media Part

🎉 That’s right Media comes first this week ‘cause I can’t wait to tell you anymore!

So, how was your social media in 2023?

That bad huh?

It doesn't have to be that way this year! A little planning can make a serious difference.

2024 will be a make-or-break for so many in this industry, and those who are serious about social media will stand out and pull away from the competition. Will you be one of them?

Join us at social.ready 2024 where we'll:

✔ Look at changes from 2023

✔ Know the upcoming trends for 2024

✔ Audit your social media and get ready for a new following

✔ Develop a personal social media strategy to follow throughout the year

✔ Create a complete social media guide and schedule

✔ Learn the tools, tips, and tricks you need to stay consistent and succeed in 2024

Come ready to get serious in 2024. Leave with a serious game plan!

You won't want to miss this one, get registered and I'll see you there!

Don't just think you're ready, know you're social.ready!

When: January 30th, 10AM-12PM EST

Where: Suffolk Punch Brewing (South Park Location)

4400 Sharon Rd, Charlotte, NC 28211

And if you aren’t local or you’re a mortgage pro like myself, don’t worry! You can join the livestream 👇

The Mortgage Part

Check out this week’s video 📽👇

🏡 Buyers are back: Mortgage applications jump as buyers take advantage of low rates and start setting off an early spring market

📉 Rate optimists: Consumer optimism scores increased after rates dropped significantly, showing that more have hope for a good housing market in 2024

📈 Inflation: Slightly higher than hoped for but effectively flat, which markets took as a good sign and reacted positively to, but we better not see it come up again next month!

😭 No March Rate Cut?: Fed President Mester says we aren't likely to see the first rate cut of 2024 in March, we'll need to see continued inflation improvement first

💳 Consumer Debt: Continues to climb as consumers add more and more to their credit card balances, keep your eyes on this 👀

💸 Gov shutdown averted… for now: Congress managed to pass a short term spending bill to avoid a partial government shutdown amid a return to Republican infighting. But only until early March so we’re just getting warmed up… again 🤦♂️

% Mortgage Rates: Basically flat with the inflation report, hovering around 6.69% to end the week

🔍 Coming this week: New construction stats, retain and home sales

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. I don’t know if you feel it to, but there are signs of an early spring coming this year. Jumps in mortgage applications and more activity in the market than we usually see in early January. What are your thoughts on the start to the year?

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.