- The Mortgage + Media Newsletter

- Posts

- I'm not scared, you're scared! 😬

I'm not scared, you're scared! 😬

Ok, maybe a little...

April 9th, 2024

So I’m a day late, but probably a dollar over! Don’t worry, you can keep the change. Most things seemed pretty good last week, other than a scary number of new jobs and that little Fed wrench!

Home inventory just keeps going up

though more folks are worried about storms nabbing their property before buyers can.

But at least jobs are staying strong,

though that may not be enough to keep the Fed off our backs.

But at least mortgage rates didn’t get too spooked

Plus, watch your inbox tomorrow for a special treat 🥰

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, let’s get to it!

The Mortgage Part

🏘 Homes in different area codes: Housing inventory has been on the rise for months now, and is 25% higher than this time last year as sellers swallow the high rate pill

🌪 It’s a twister!: Homeowners are becoming increasingly worries about storm damage and insurance costs as weather events become more frequent and intense

👷♀️ The best kind of bad news: We added WAY more jobs than expected last month, which is great for the unemployment rate, but is it good for all the other rates?

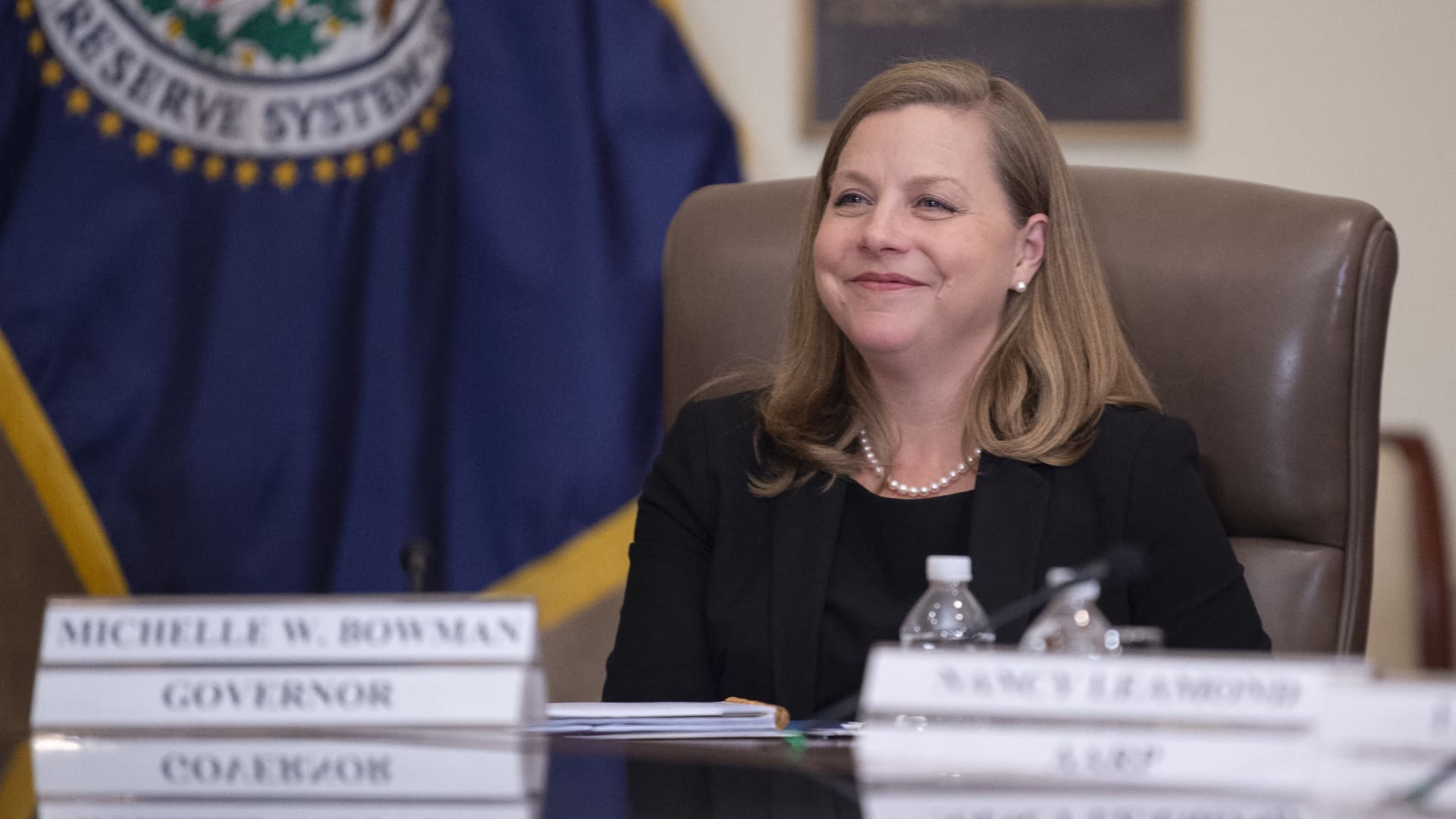

🤦♀️ Let me just scare everyone real quick: The Fed isn’t scared to talk about the horror of additional interest rate hikes being needed, but we’re terrified to hear it!

% Mortgage Rates: Despite the potential looming terror, rates actually stayed pretty flat this week. That means markets are still pretty confident about rates dropping later this year

🔍 Coming this week: The big CPI inflation report comes out on Wednesday, then a whole host of Fed officials will give us their 2 cents about the future of rates

The Media Part

I told you so!!

Instagram is FINALLY testing longer Reel options. These longer videos have been trending on TikTok for some time, and IG was trying to fight the wave. But it looks like Meta is giving in to users and getting ready to give them what they want. So be prepared to start utilizing this feature and make content that will hold attention longer and get more engagement from your viewers. Here are the highlights about the IG testing:

Instagram is expanding its testing of longer Reels, now allowing some users to upload videos up to 3 minutes long.

The current limit for Reels is 90 seconds, and Instagram has been experimenting with even longer durations, such as 10 minutes.

Meta (Instagram's parent company) reported a 20% increase in Reels consumption year-over-year, with AI-driven content recommendations contributing to this growth and boosting activity on both Instagram and Facebook.

Instagram's push for longer Reels is aimed at increasing user engagement by offering more extended content, moving away from its original focus on social connectivity.

This change aligns with a trend observed on TikTok, which is also encouraging the posting of longer videos to enhance user engagement and broaden content consumption habits.

TikTok recently introduced a Creator Rewards Program to incentivize the creation of longer video content with cash rewards.

I for one am hella excited about this. Longer content is becoming the new norm, and we need to jump on board if we want to stay relevant.

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. This week watch for that CPI report! If we see it come in over 3%, expect some mortgage rates to jump. But, if the drop under 3%, we could see some positivity drop them down a bit.

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.