- The Mortgage + Media Newsletter

- Posts

- Let's put a smile on that face!

Let's put a smile on that face!

Because last week we actually has something to smile about

March 25th, 2024

Well last week there were a few nice surprises, some close calls, and only a little bad news (but we’re pretty used to at least some of that)

The Fed said they’re keeping rates high, and we actually liked it

and dropped mortgage rates to celebrate!

Plus home sales were way up in February

(even if it might not stay that way)

and home builders are feeling all tingly inside

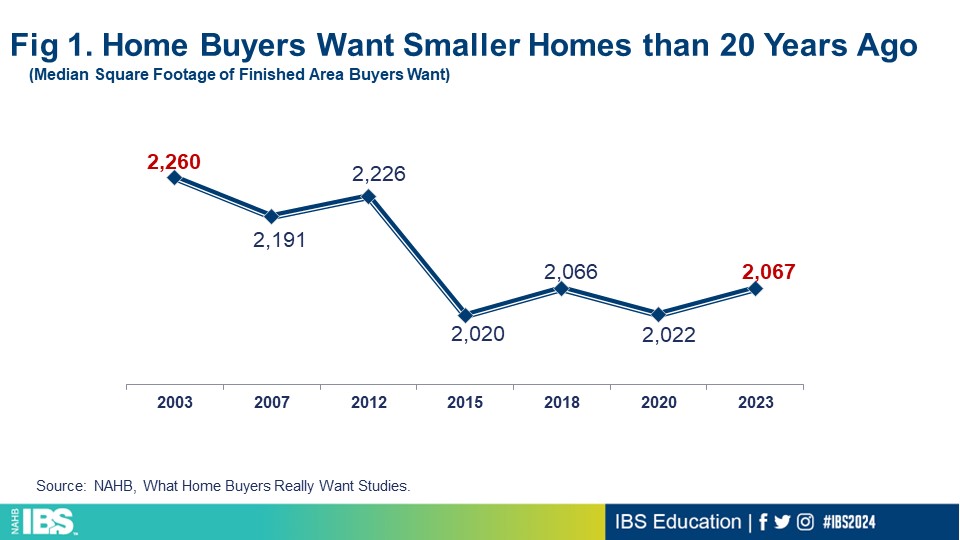

because home buyers are ready do go small

(because home prices are a little insane).

And bonus, the government didn’t shut itself down so that’s a yay!

Plus, watch your inbox tomorrow for a special treat 🥰

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, let’s get to it… with Media first today!

The Media Part

I’m gonna keep it short and sweet. The best advice I can give you if you’re looking to not suck at social media anymore, is to come to the event I’m hosting with the one and only @kimsellsconcord on Wednesday!

We’re going to give you the only 2 tools you need to be great at social media: green screen and storytelling.

I promise you can do both, just click the link to get details and get registered for the online or in-person (if you’re a CLT Realtor) event.

See you there!

The Mortgage Part

🏛 The Fed Feels Fuzzies: With the economy, even though inflation has been stubborn. They decided to keep rates as is, but still plan to cut them 3 times this year.

🏠 Home Sales Were Golden: With a 9.5% spike in February as inventory starts to come online and buyers stay hungry despite higher-than-expected rates

📉 But Will It Last?: New estimates show fewer sales in 2024 than we thought as rates stay higher for longer than we hoped. But buyers may surprise us…

👷♀️ Happy Homebuilders: New construction has a bright future, finally, according to the most recent builder sentiment survey, which turned positive for the first time in months

⛺ Go small and go home: New construction has a bright future, finally, according to the most recent builder sentiment survey, which turned positive for the first time in months

📈 Home price hikes: Another new survey shows that home prices have far outpaced inflation, highlighting the current strain on homebuyers

😲 The Government is Still Running: In a last minute scramble, Dems and Repubs got together to pass a $1.2T spending bill to keep the government from shutting down

% Mortgage Rates: With the good news from The Fed and potential rate cuts, we managed to drop back under 7%!

🔍 Coming this week: We have home sales, home prices, and the anticipated PCE inflation report

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. This week celebrate our wins from last week and go out there to take advantage of this upcoming spring market!

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.