- The Mortgage + Media Newsletter

- Posts

- Well our credit is shot, but at least it's cheaper now...

Well our credit is shot, but at least it's cheaper now...

because it's not getting any easier

March 11th, 2024

This week was a mixed bag

Biden sends junks fees to the landfill

just in time for us to stop paying our bills.

The Fed doubles down on their “higher for longer” policy

while layoffs pop up

and employment starts to slide.

And the government didn’t shut down, but the bigger fight still looms.

Oh, and rates actually got a lot better this week too!

Plus, LinkedIn just gave itself and industry-expert-chiq facelift

Really quick, if someone forwarded this email to you, don’t settle for being at mooch. Sign up and get it for yourself here 👇

Ok, let’s get to it!

The Mortgage Part

💳 Junk Fees: Biden administration cracks down on bank fees, setting a max of $8 fees for credit card lates

📉 Credit Hit: Good thing too, because the average credit score just dropped for the first time in 10 years as increasing debt starts catching up to us

⛔ No Cuts For You: Jerome Powell doubled down on the "sit and wait" policy, stating rates can't come down until inflation starts making substantial moves toward 2%

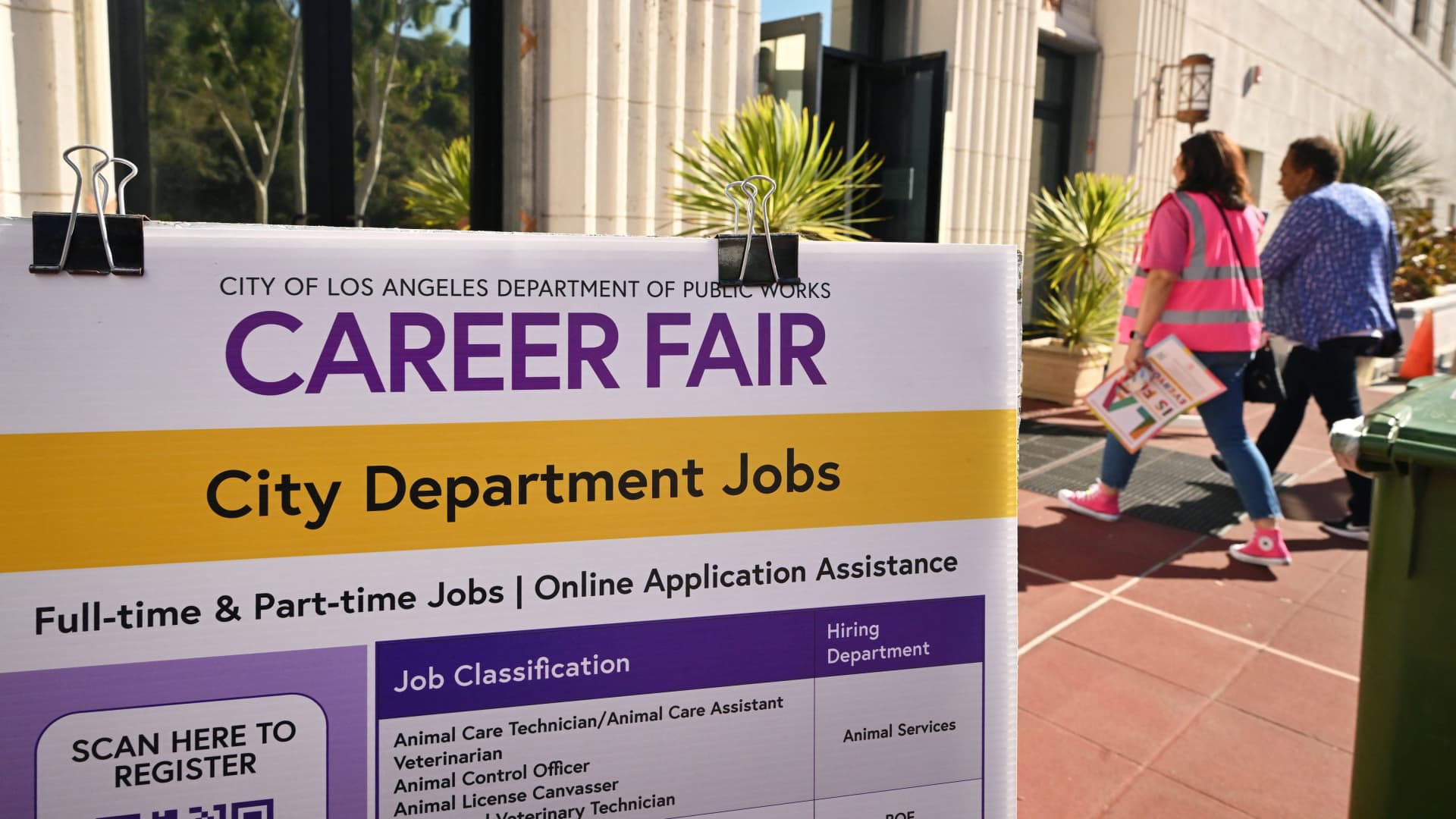

📈 Layoff Pop: February layoffs, especially in Tech, were the worst we've seen for that month since the Financial Crisis

👷♂️ Employment Drop: We saw the unemployment rate make a rare move upward. But could this be good news for rates?

🏛 Crisis Averted?: Congress actually managed to fund the government thru September. Well, half of it at least. They’ll be back to battling over spending for the other half in 2 weeks

% Mortgage Rates: Speaking of which, we saw them drop back under 7% to the lowest they've been in over a month!

🔍 Coming this week: We have the consumer price index to tell us how much things are costing us, and retail sales to tell is how much of them we bought

The Media Part

🎯 Massive LinkedIn Updates! An opportunity to take a new look at the platform

Shifting Focus: LinkedIn is prioritizing professional publishers over creators to connect professionals with economic opportunities.

This could be a great opportunity to start prioritizing LinkedIn, especially if you struggle with the other, more trend-heavy platforms. We’ll discuss this more later, and be on the lookout for an upcoming training on this. For now let’s check out the details of this move:

Collaboration with Publishers: Working with 400+ news publishers globally, LinkedIn's editorial team informs them of trending topics for better post optimization.

Niche Approach: Unlike Meta, LinkedIn's niche approach fosters positive and informative engagement, catering to professionals seeking career-relevant insights.

Removal of Creator Mode: LinkedIn removes "Creator Mode" to focus on industry expertise rather than in-stream influencers.

Investment in Publications: LinkedIn is investing in its podcast network and running a video sponsorship pilot with selected publishers to promote high-quality content within specific niches.

Growth of Newsletters: A 150% increase in newsletters published on LinkedIn over the past year provides marketers more opportunities to target specific niches.

Algorithm Update: LinkedIn updated its feed algorithm to prioritize insightful posts over trending updates, enhancing the platform's value for professionals.

Marketing Opportunities: Marketers are encouraged to explore niche discussions on LinkedIn within their brand sectors for increased marketing value.

What do you think, is there potential for you with these changes, or is it just more confusing now?

Well that’s it for the best (and likely only) Mortgage AND Media Newsletter out there. This week instead of calling clients, spend your days calling your Washington reps and tell them to get their 💩 together before all of it hits the fan!

And as always, I’m happy to help you and your clients with anything mortgage, marketing, or social media. See you next week and

Thanks for reading!

John Birke | Mortgage Advisor | Content Coach

NMNLS 1150795

Movement Mortgage

9726 Old Bailes Road, Suites 121 & 130, Fort Mill, South Carolina 29707

NC-I-211026, SC-MLO-1150795, AR-128178, MO-1150795, OK-MLO29209 | Movement Mortgage LLC. All rights reserved. NMLS ID #39179 (www.nmlsconsumeraccess.org). Interest rates and products are subject to change without notice and may or may not be available at the time of loan commitment or lock-in. Borrowers must qualify at closing for all benefits. For more licensing information please visit movement.com/legal.

Please be aware that e-mail is not a secured communication vehicle, and that others may in certain circumstances be able to view its contents. As a result, while we are happy to provide this information by e-mail, we do not conduct actual business transactions by e-mail. Please contact the sender directly if you have any concerns about this message. All loans subject to credit approval and property appraisal. This communication is confidential and propriety business communication. It is intended solely for the use of the designated recipients(s). If this communication is received in error, please contact the sender and delete this communication.